A Third Party Administrator (TPA) performs an important purpose in many sectors, notably in wellness insurance plan, where by they work as intermediaries among insurance policy providers and policyholders. But what precisely is often a TPA? Fundamentally, a TPA is undoubtedly an entity that manages administrative tasks related to insurance plan claims and benefits on behalf of insurance plan organizations. This outsourcing enables coverage companies to aim far more on Main functions like underwriting and coverage administration although entrusting administrative procedures to specialised third functions.

TPAs handle A selection of tasks, mainly centered all over processing claims proficiently and properly. Their duties contain verifying assert validity, determining coverage eligibility, and processing payments to healthcare suppliers. By streamlining these responsibilities, TPAs help minimize administrative burdens for insurers, guaranteeing quicker resolution of claims and improved buyer gratification.

In the context of well being insurance policies, TPAs are pivotal in taking care of health benefits for policyholders. They act as liaisons in between insurers, healthcare providers, and insured people, making certain smooth communication and efficient processing of healthcare claims. This function is particularly critical in managing complicated healthcare billing procedures and navigating regulatory necessities.

The value of a TPA while in the healthcare sector cannot be overstated. They offer abilities in statements management, assisting to Regulate charges by negotiating favorable charges with healthcare vendors. Moreover, TPAs boost transparency by supplying in-depth stories on claims processing and expenditure, enabling insurers to make knowledgeable decisions about protection and pricing.

Selecting a dependable TPA is paramount for insurance policies organizations on the lookout to keep up high criteria of support supply. Trustworthy TPAs show reliability in statements processing, adherence to regulatory standards, and robust customer care. This reliability is very important in preserving insurance provider-client associations and upholding the reputation of insurance policies vendors in aggressive Trusted Third Party Administrators markets.

For organizations and insurers trying to get nearby TPA expert services, considerations usually involve familiarity with regional Health care providers, knowledge of neighborhood regulatory frameworks, and responsiveness to localized buyer requires. Local TPAs can provide customized provider and more quickly reaction periods, that are advantageous in handling regional insurance policy operations successfully.

In states like Minnesota and Michigan, TPAs cater to certain regional needs and laws governing insurance policy operations. Local TPAs in these locations are very well-versed in condition-certain regulations and regulations, making sure compliance and seamless integration with community healthcare networks.

The most effective TPAs distinguish themselves as a result of a mix of effectiveness, trustworthiness, and shopper-centric support. Coverage companies generally Appraise TPAs based mostly on their history in claims administration, consumer gratification Tpa In Health Insurance rankings, and technological abilities. These variables contribute to picking out a TPA that aligns Together with the insurer's operational plans and enhances In general support supply.

In conclusion, TPAs Enjoy a vital position in the coverage ecosystem, specifically in running administrative functions and boosting support efficiency. Their duties span throughout many sectors, using a Key focus on healthcare the place they aid seamless statements processing and gain administration. Selecting the appropriate TPA entails criteria of dependability, abilities, and alignment with area regulatory requirements, making sure optimal assistance delivery and buyer pleasure in insurance coverage operations.

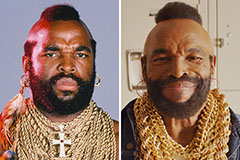

Mr. T Then & Now!

Mr. T Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Kenan Thompson Then & Now!

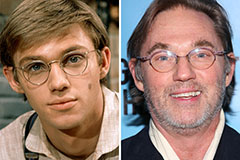

Kenan Thompson Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!